Article ID: KB0082

In many commission systems, a total commission is calculated for a sales document and that total may then be distributed (split) to multiple salespeople. Since Commission Plan calculates the commission independently for each salesperson for each sales document line item, and each salesperson may have a different commission rate for each line item, there is no pre-determined total commission for the sales document. Therefore, splits in Commission Plan are defined as a percentage of the salesperson’s normally calculated commission.

Commission Plan provides for two Split Calculation Methods:

- Calculate the commission amount, and then multiply by the split percentage.

The commissionable sale and cost amounts on commission line items are NOT affected by the line item Split percentage when the Reduce Commissionable Amounts for Splits checkbox is UNmarked on the Comm Amts tab of the Commission Plan setup window.

[Sales Area Page > Setup > Commission Plan > Commission Plan Setup]

Example: Paul normally receives a commission of 10% of the margin of an item and Paul’s split percentage is 30% for a sales document, whose line item sale amount is $100.00 and line item cost amount is $60.00.

Split Calculation: The commissionable sale amount is $100.00, the commissionable cost amount is $60.00. The gross commission amount is $4.00 [($100.00 – $60.00) * 10%], and the net commission amount is $1.20 [$4.00 * 30%].

- Multiply the commissionable sale and cost amounts by the split percentage, and then calculate the commission amount.

The commissionable sale and cost amounts on commission line items are reduced by the line item Split percentage before the commission line is calculated when the Reduce Commissionable Amounts for Splits checkbox is marked on the Comm Amts tab of the Commission Plan Setup window.

[Sales Area Page > Setup > Commission Plan > Commission Plan Setup]

Example: Paul normally receives a commission of 10% of the margin of an item and Paul’s split percentage is 30% for a sales document, whose line item sale amount is $100.00 and line item cost amount is $60.00.

Split Calculation: The commissionable sale amount is $30.00 [$100.00 * 30%], the commissionable cost amount is $18.00 [$60.00 * 30%], and both the gross and net commission amounts are $1.20 [($30.00 – $18.00) * 10%].

NOTE: If the Quotas matrix option is selected, the Reduce Commissionable Amounts for Splits option is required to be marked.

How does the Roll Down Header Splits to Commissions Lines option affect commissions?

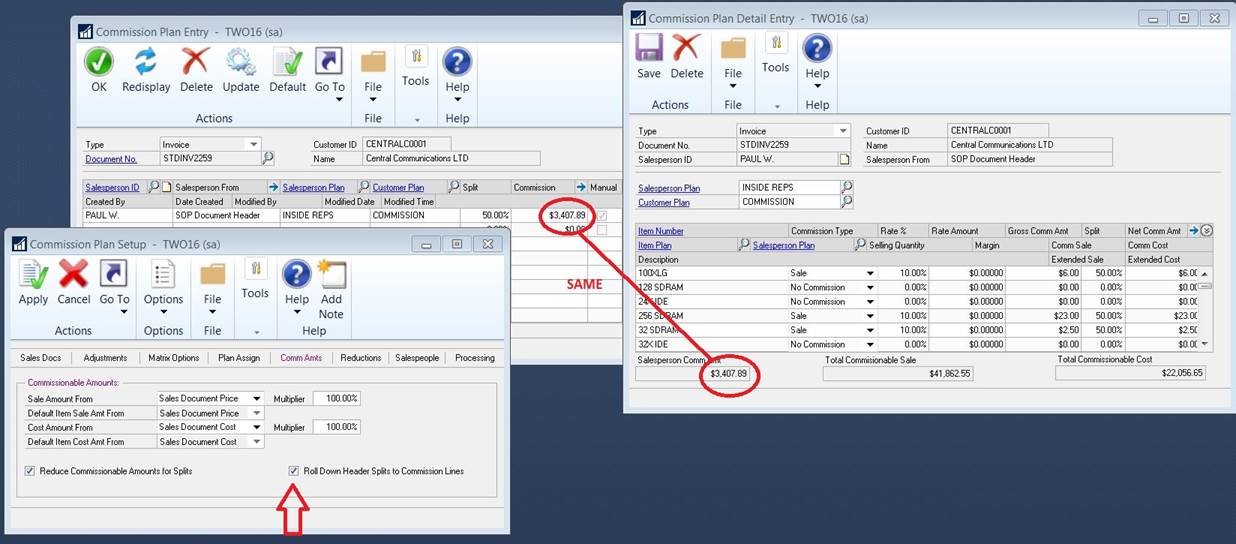

When the Roll Down Header Splits to Commission Lines checkbox is marked, a split percentage entered for a commission record in the Commission Plan Entry window [Sales Area Page > Transactions > Commission Plan > Commission Plan Entry] will appear on all commission lines, overriding any automatically calculated commission line split percentages. The header net commission amount will equal the header gross commission amount (the sum of all commission line net commission amounts). When the Roll Down Header Splits to Commission Lines checkbox is UNmarked, a split percentage entered for a commission record in the Commission Plan Entry window [Sales Area Page > Transactions > Commission Plan > Commission Plan Entry] will not affect any commission lines. The header net commission amount will be calculated by multiplying the header gross commission amount (the sum of all commission line net commission amounts) by the header split percentage.

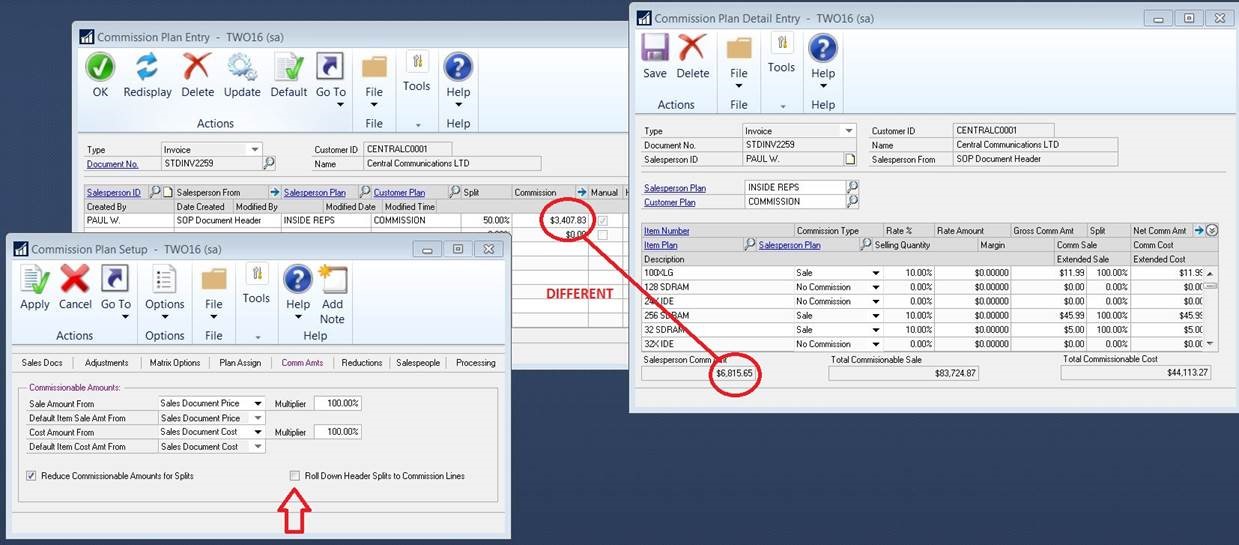

When the Roll Down Header Splits to Commission Lines checkbox is UNmarked, a split percentage entered for a commission record in the Commission Plan Entry window [Sales Area Page > Transactions > Commission Plan > Commission Plan Entry] will not affect any commission lines. The header net commission amount will be calculated by multiplying the header gross commission amount (the sum of all commission line net commission amounts) by the header split percentage.

Comments